Видео ютуба по тегу How Much To Pay When Filing Extension

YOU FILED A TAX EXTENSION Mobile Video

Forgot to file an extension or make a payment for your individual income tax return?

IRS Extension Does Not Cover Tax Payment #shorts #irs #taxes @QuickTaxAccountingSolutionsInc

Can I Get A Tax Payment Extension? - Your Guide to Budgeting

Tax Extension Extra Time to Pay What You Need to Know Before April 15 #shorts

An extension delays filing—not payment. AVOID IRS PENALTIES

TAX FILING EXTENSION TO FILE EXTENSION TO PAY #shorts

file IRS extension for free online with Direct pay (almost free) #filingseason #irs

Extension to File, NOT Extension to Pay...12 Hours LEFT!

IRS Filing and Payment Extension for All Tennessee Residents

Tax Extension Does Not Give You More Time to Pay

File for an extension but pay what you owe. Late payments mean penalties and interest – act now!

Tax Deadline 2025 - IRS Extension Rules - Penalty and Payment Advice

Tax Deadline 2025 - IRS Extension Rules - Penalty and Payment Advice

Need more time to file? Extension gives 6 months to file, but payment is still due now!#cpa#tax

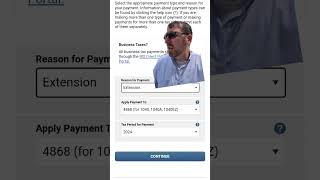

How to file an online extension using IRS Direct Pay method.

Need to pay taxes with your extension? Watch this to learn how to or contact us! Link is in our bio.

Tax extension only gives you more time to file, NOT more time to pay. 😳

Why you should file for an extension and not stress about April 15th for Taxes

Tax Deadline Reminder: Extension To File Not Pay!